Your generosity has already made an incredible impact on the lives of young people — the very kids this foundation was created for. Since it began in November 2017, Opportunity 34 has awarded more than $80,000 in scholarships, not to mention put smiles on the faces of dozens of kids at the Madison Allied Drive Boys & Girls Club through our “Rescued Soles” shoe drive. It has all been incredibly inspiring. And, we’re only getting started.

Your generosity has already made an incredible impact on the lives of young people — the very kids this foundation was created for. Since it began in November 2017, Opportunity 34 has awarded more than $80,000 in scholarships, not to mention put smiles on the faces of dozens of kids at the Madison Allied Drive Boys & Girls Club through our “Rescued Soles” shoe drive. It has all been incredibly inspiring. And, we’re only getting started.

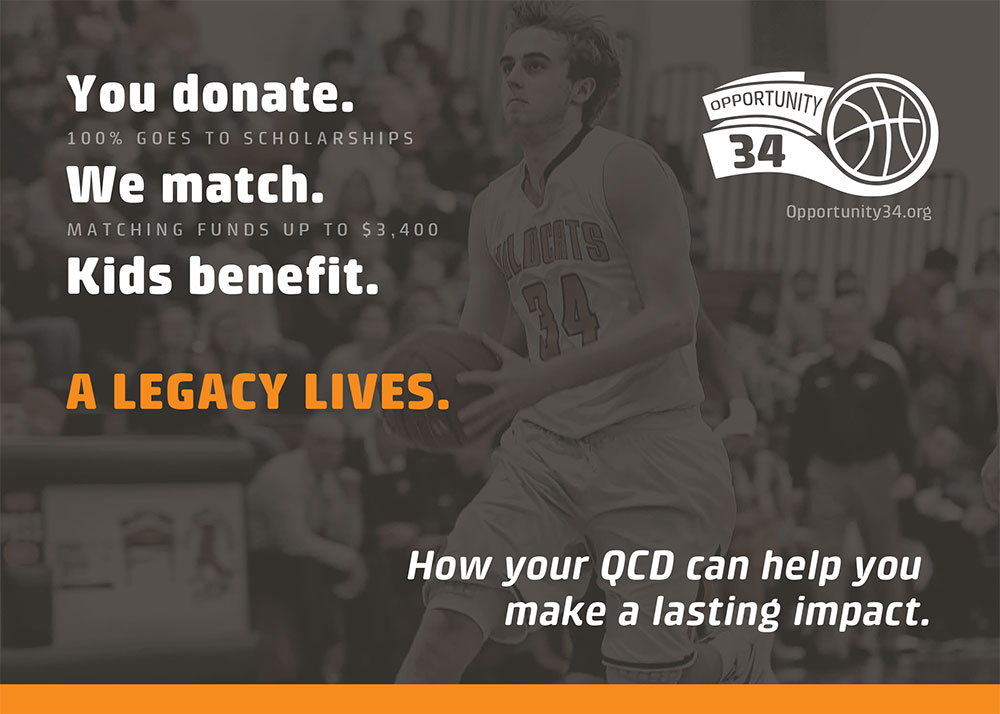

On March 12, 2019, the Opportunity 34 Foundation, Inc., was recognized by the IRS as a public charity under IRC section 501c3 (view press release). This mission to provide opportunities for kids who may otherwise otherwise not have them, we are reminded of a great year-end strategy for those needing to take a required minimum distribution from their IRA. There’s an opportunity with a QCD.

On March 12, 2019, the Opportunity 34 Foundation, Inc., was recognized by the IRS as a public charity under IRC section 501c3 (view press release). This mission to provide opportunities for kids who may otherwise otherwise not have them, we are reminded of a great year-end strategy for those needing to take a required minimum distribution from their IRA. There’s an opportunity with a QCD.

A Qualified Charitable Distribution is a perfect opportunity to make a lasting impact. When planning your IRA withdrawal strategy, you may want to consider making charitable donations through a QCD.

By making a direct transfer of funds from your IRA to a qualified charity, your QCD can be counted toward your required minimum distribution for the year.

If you are over 70½, you are eligible to make a qualified charitable donation of up to $100,000 to the 501(c)(3) Opportunity 34 Foundation — and we’ll match your donation up to $3,400. Ask your financial advisor, accountant or attorney about how your QCD can make a lasting impact in your community. Thanks again for your continued support!

The Opportunity 34 Foundation does not offer tax or legal advice. You should always speak with your financial advisor, accountant and/or attorney before making any financial decisions.